33+ Fha loan qualification calculator

Find a mortgage that fits your budget based on your monthly income and expenses. For conventional loans the minimum is 3 percent for certain buyers and 5 percent for most buyers.

Kenny Idstein Loandepot

After going through our program many of our customers end up being a good fit for an FHA loan.

. The term is the amount of time you have to repay a loan. FHA loans offer eased lending options with low down payments affordable closing costs and easy credit qualification. If your credit score is between 500 to 579 you must make a 10 percent downpayment to secure the loan.

Here are 2. Certain loans such as VA loans or USDA-backed loans do not require a down payment but there can still be. With the onset of the COVID-19 pandemic in early 2020 unemployment rates rose as high as 147 in April according to the Bureau of Labor StatisticsMany households struggled to make mortgage payments between April to July 2020.

The minimum down payment for an FHA loan is 35 percent. The loan is secured on the borrowers property through a process. If you need a higher loan amount the SBA can guarantee up to 75 percent.

The following table shows the rates for ARM loans which reset after the tenth year. They allow borrowers to have 3 more front-end debt and 7 more back-end debt. This option is appropriate for first-time homebuyers with less than perfect credit scores.

We can show you how to meet FHA home loan requirements. FHA loan income requirements. Borrowers are still responsible for property taxes or homeowners insuranceReverse mortgages allow older.

An SBA 7a loan may guarantee up to 85 percent of the loan amount if the mortgage is 150000. Auto loan term. The principal is the actual loan amount you borrowed from your lender.

Check Out Our Related IO Loan Calcualtors. Likewise a considerable number of homebuyers put their purchases on hold until they could. Calculator results do not reflect all loan types and are subject to individual program loan limits.

SBA 7a loans fully amortize and typically paid up to 25 years. Pre-qualification is a casual estimate that determines how much money you can borrow for a mortgage. FHA insures mortgages on single-family multifamily and manufactured homes and hospitals.

You may ask How much can I borrow for a mortgage based on my income For the most part 33 of gross income is a good rule. FHA loans come in. So that the calculator bases your loan limit on the back-end.

It is the largest insurer of mortgages in the world insuring over 34 million properties since its inception in 1934. But except for the years following the late 2000s financial crisis 2010 2015 for a couple of years FHA loan rates were lower than conventional mortgages. Allowing down payments as low as 35 with a 580 FICO FHA loans are helpful for buyers with limited savings or lower.

Current 10-Year Hybrid ARM Rates. This makes it a popular financing option for buyers with tight finances. FHA loans have more lax debt-to-income controls than conventional loans.

FHA loans also require 175 upfront premiums. Its a popular financing tool among first-time homebuyers who have yet to. We also have calculators which you can use to.

Use our free home affordability calculator to estimate how much home you can afford. Since the year 2000 FHA loan rates were usually 0125 to 025 higher than conventional loans. The loans are typically promoted to older homeowners and typically do not require monthly mortgage payments.

Fixed-Rate Mortgage FRM A mortgage loan in which the interest rate remains the same for the life of the loan. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged. An FHA loan is a mortgage insured by the Federal Housing Administration.

This loan can be taken as fixed-rate mortgage a variable-rate mortgage or as a combination of the tow. USDA Loans the COVID-19 Pandemic. The results of the above calculator can offer a rough idea of max loan qualification however for most people it is better not to.

FHA loans are very popular first-time home buyer loans. In the context of real estate mortgages amortization literally from the Greek to die off or die down means the graduated lowering of the principal payment of the amount owed as the borrower makes principal and interest P I payments thereby reducing or killing off the. Some mortgage programs - FHA for example - qualify borrowers with housing costs up to 31 of their pretax income and allow total debts up to 43 of pretax income.

Todays national mortgage rate trends. The most common loan terms are 24 36 48 60 72 and 84. FHA minimum down payment.

FHA minimum credit score. FHA mortgages usually come in 15 and 30-year fixed rate terms. It allows borrowers to qualify even if they have low credit scores.

For today Thursday September 15 2022 the current average rate for a 30-year fixed mortgage is 619 increasing 11 basis points compared to this time. A minimum of 500 preferably 580. Results are based on a debt-to-income ratio of 43.

Use this calculator to figure home loan affordability from the lenders point of view. Amortization is a simply a verbose way of referring to the process of a loans decrease over its lifetime. The reason that FHA loans can be offered to riskier clients is the required upfront payment of mortgage insurance premiums.

Ideally 620 and up has flexible credit standards. The most common loan terms are 24 36 48 60 72 and 84 months. With FHA loans you can make a smaller downpayment to obtain a 30-year fixed-rate mortgage.

Loan Term this is the length of your payment duration or the number of payments. To lower the principal amount you can put forward a higher down payment. If no results are shown or you would like to compare the rates against other introductory periods you can use the products menu to select rates on loans that reset after 1 3 5 or 7 years.

1500 100 400. If your interest-only loan is a mortgage we also offer an interest-only mortgage calculator an IO calculator with extra payments and an IO ARM calculator. Refinancing from a 30-fixed FHA loan to a 15-year fixed-rate conventional loan eliminates MIP and helps slash interest charges.

The greater the principal amount the higher your monthly payment. A reverse mortgage is a mortgage loan usually secured by a residential property that enables the borrower to access the unencumbered value of the property. This calculator defaults to a 15-year loan term and figures monthly mortgage payments based on the principal amount borrowed the length of the loan and the annual interest rate.

You can get an FHA loan with a credit score of 580. This is a general estimate not an actual amount. This calculator figures monthly FHA loan payments based on the principal amount borrowed the length of the loan and the annual interest rate.

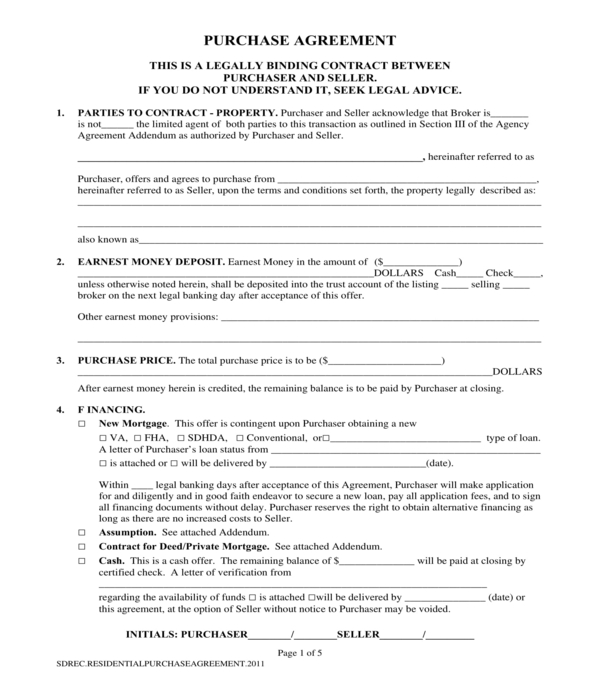

Free 5 Land Purchase Agreement Forms In Pdf

Sellers Beware 33 Buyer Outs Texas Title

2

Kenny Idstein Loandepot

Youtube Channel Name Ideas For Facts Best Creative And Unique 700 Facts Youtube Channel Name Ideas And Suggestion

2

Free 11 Mortgage Broker Business Plan Samples In Google Docs Ms Word Pages Pdf

Pin On Naca Event Locations

Difference Of Sap Systems Applications And Products Vs Oracle Netsuite Which Erp Software Is The Best For Business

Kenny Idstein Loandepot

The Home Buying Process In 10 Simple Steps Great Tips For First Time Home Buyers Realestate Home Buying First Home Buyer Buying First Home

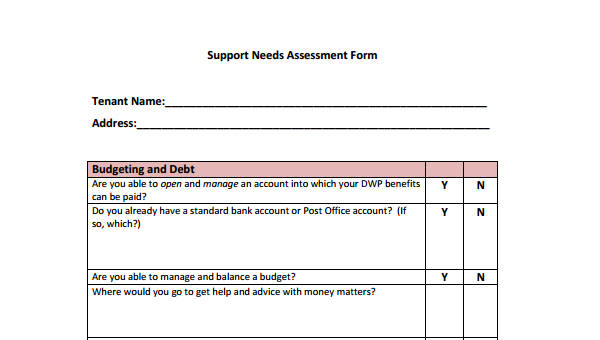

Free 31 Needs Assessment Forms In Pdf Excel Ms Word

Kenny Idstein Loandepot

Kenny Idstein Loandepot

Kenny Idstein Loandepot

Avoid Foreclosure Moshes Law Firm 888 445 0234

Kenny Idstein Loandepot